Pasar saham Asia sebagian besar bergerak naik sedikit pada perdagangan Rabu (13/03/2024), karena saham-saham teknologi utama mengikuti kenaikan Wall Street

Diperbarui • 2022-11-23

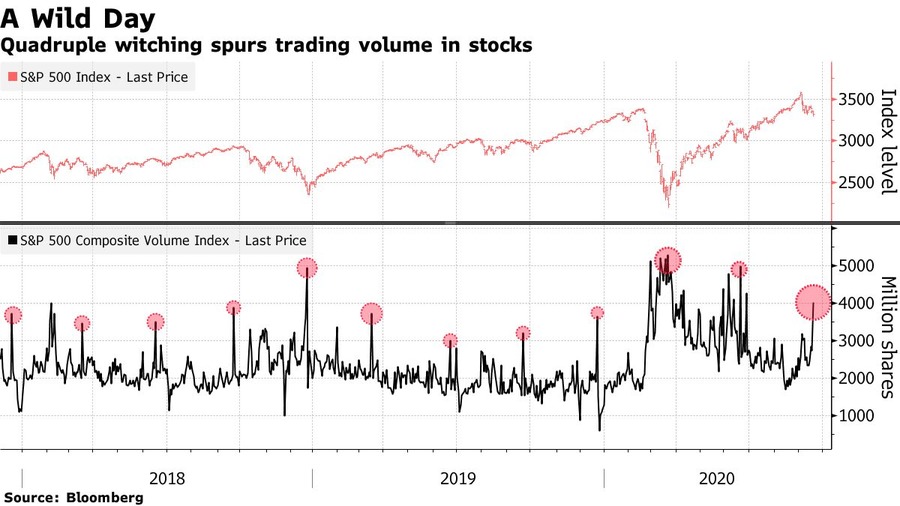

Besides US Retail Sales data, Australian Unemployment Rate and New Zealand GDP this week will bring us Quadruple Witching – one of the four most important days of a year for futures and options!

Quadruple witching refers to four days during the calendar year when the contracts on four different kinds of financial assets expire. The expiration date is the point at which a position automatically closes. In other words, traders will have to decide what they want to do with their open position before the expiry date. The days are the third Friday of March, June, September, and December. The assets are:

Options contracts also expire monthly. Futures contracts expire quarterly. Because traders and institutions run out of time at the close of trading, there is a lot of portfolio re-balancing, contract rollovers, and more. The last hour of the trading session (22:00 to 23:00 GMT+3) is when the volatility really increases, and assets swing dramatically.

Because all four types of contracts expire on the same day, the quadruple witching day is usually accompanied by bigger trading volumes and volatility. On June 18, 2021, a quadruple witching day, a near-record volume of single-stock equity options was set to expire at the end of the day in the amount of $818 billion. As a result, a near-record of single stock open interest of about $3 trillion stood on June 18, 2021. Open interest refers to how many contracts are open during any given point during the day. It is an important metric for traders to watch since a large amount of open interest can move the value of the underlying stock.

But you need to know, that these Freaky Friday days (the second name for the day is even stranger than the first) in general are not bullish or bearish. You cannot just buy or short sell and make guaranteed money. What is guaranteed, however, is that there will be a big surge of volatility. There is on average 40% more volume on this day than the average.

Source: https://www.bloomberg.com/news/articles/2020-09-18/stock-traders-brace-for-quadruple-witching-amid-options-anxiety?sref=qgDWnyMx

Also, note that the last hour of the session is usually bearish because long positions are prevailing against short ones, and closing these trades might cause a plunge in prices.

US 500 and US 100 will be more volatile this Friday. Because of trading volumes, US 500 index will be able to reach distant resistance at 4370 or plunge through the 4450 level (if the Index doesn’t do this earlier this week).

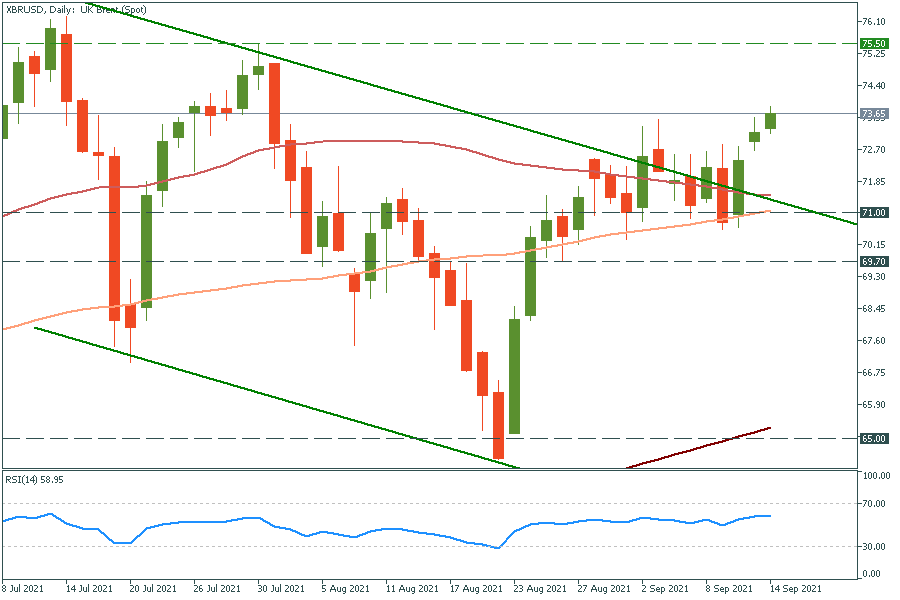

The same goes for oil, gas, and gold, so keep an eye on XAU/USD, XNG/USD, and XBR/USD. Brent oil is surging for several days already, so we may see strong pullbacks to the $71 level.

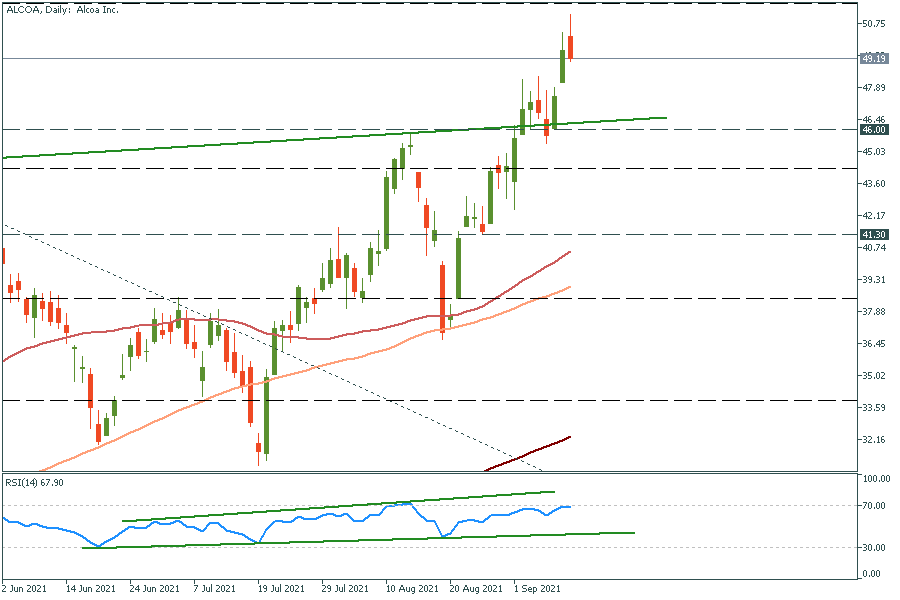

In stock market, consider trading such companies as Tesla or Alcoa because they either have huge options volume or are commodity-based. Moreover, Alcoa is on the rise because the aluminum price is skyrocketing. Both rise to $52 and plunge to $46 levels are possible.

Pasar saham Asia sebagian besar bergerak naik sedikit pada perdagangan Rabu (13/03/2024), karena saham-saham teknologi utama mengikuti kenaikan Wall Street

Pasar saham Asia sebagian besar terkoreksi pada perdagangan Jumat (01/03/2024), kecuali indeks Nikkei Jepang menuju rekor tinggi, didukung oleh penguatan di Wall Street.. Indeks S&P 500 dan Nasdaq ditutup pada rekor tertinggi

Pasar saham Asia bergerak bervariasi pada perdagangan Kamis (22/02/2024), mengikuti sinyal positif dari Nvidia, saham favorit AI, Risalah pertemuan Federal Reserve (FOMC minutes) pada bulan Januari menunjukkan sebagian besar pembuat kebijakan khawatir terhadap risiko

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!